Real Estate Fund

Investments backed by bricks and concrete

4 - 6% per annum

Target return

70,00 %

Return since fund launch

64 properties

in 5 European countries

from 100 CZK

minimum investment amount

WHY INVEST IN THE INVESTIKA FUND?

What you get from the fund

You don't have to raise money to buy your own investment real estate, or spend time renting it out. In this investment fund, from as little as CZK 100, you get a worry free stake in real estate worth billions of crowns and a share of its rental income. The fund's income is furthermore shielded from inflation thanks to inflation clauses in lease contracts.

Stable and inflation-proof returns

The long-term sustained demand for commercial space in the Central European region makes the Real Estate Fund an ideal investment opportunity for those seeking stable returns. This is even inflation-proofed by lease agreements in fund properties containing inflation clauses as standard. Rents therefore increase in line with inflation, increasing rental yields even in poor economic times.

Conservative investments with solid fundamentals

A seven-point scale is used to measure the riskiness of investments, and INVESTIKA Real Estate Investment Trust scores the second lowest on the scale at 2. This means that an investment in the fund is rather low risk, which should be appreciated by those otherwise apprehensive about investing.

One-off and regular investments from as little as CZK 100

You don't need to have banked millions to make money from property. From just CZK 100, invested regularly or on a one-off basis, you can earn from billions of crowns worth of property and rental income.

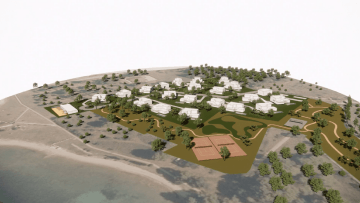

Diverse property portfolio

The real estate portfolio includes dozens of commercial properties of various types - office buildings, industrial and logistics sites, shopping centres and more. The stability of returns is underpinned by having properties not only in the Czech Republic, but other countries such as Poland, Austria and Croatia. If the sector struggles in one country, it does not affect the entire fund portfolio. This fund focuses on attractive locations and creditworthy tenants from wideranging sectors, with whom it concludes long-term contracts. All of this means the predictability and assurance of long-term stable returns.

Annuity option

When investing in the real estate fund, you can use returns to continue investing and withdraw them in the future, or take advantage of a monthly annuity. This resembles the rental income you would receive from renting out your own property. You can set up an annuity paid monthly or quarterly on the amount that your investment in the real estate fund appreciates. You can use the annuity for whatever you wish, or invest it regularly in another of our funds.

Responsible investment

We wish to create places to live and work that also consider the environment and don't place unnecessary strains on it. Thus you'll find properties in our real estate fund selected or retrofitedt with energy efficiency in mind. We invest in properties promising both in financial returns and the future. For more information, see Sustainability-related information.

Chart of the value of the INVESTIKA real estate fund

for the selected period

Fund objective and strategy

The objective of the INVESTIKA Real Estate Fund is through investments in real estate assets. To achieve long-term stable returns in line with the real estate market, while maintaining a reasonable level of risk

We invest mainly in premium office buildings, shopping centres, logistics complexes and other sectors.

Long-term leases include inflation clauses ensuring regular rent increases.

The combination of creditworthy tenants and long-term lease contracts is the prerequisite for the Fund‘s stable income.

The portfolio is diversified according to property type, location and tenant level.

Property portfolio

Offices

In the long term, this is the most stable sector of commercial real estate. Our portfolio includes both "A-grade" office buildings in Prague and office buildings in the Czech regions, less sensitive to potential market changes due to the lower supply of such properties in their respective locations. However, office properties in the Polish cities of Katowice, Gdynia and Poznan are also strongly represented in the fund's portfolio. The size and nature of the Polish market allows for transactions of necessary volume with the required yields, which are scarce in the relatively small domestic market. Our office building portfolio is thus wide-ranging in the quality and sector focus of tenants and in country or region, which significantly contributes to the diversification and stability of the fund.

Business centres

In preference to premium shopping centres, which are significantly exposed to external influences including the decline of tourists, INVESTIKA Real Estate Fund focuses on smaller and medium-sized local centres for everyday shopping, which can withstand potential market turbulence. An example is the Galerie Butovice shopping centre, which relies on a residential and office community in a popular location near the Nové Butovice metro station in Prague 5.

Logistics, industrial & data centres

This is currently a sought-after sector, and is strengthening significantly. Among the long-term factors for its growth is the expansion of e-commerce, which requires logistics facilities. This sector is characterised by high occupancy rates and the low supply of suitable buildings. The value of logistics real estate is mainly created by long-term lease contracts and the attractiveness of locations with an emphasis on good transport access.

Bank houses

These properties, conservative by nature, function in INVESTIKA Real Estate Fund's portfolio mainly as a stabilising element, as their long-term tenants include the largest Czech banks. The financial sector in the Czech Republic has repeatedly demonstrated strong resilience to economic and market fluctuations. The advantage of the banking properties owned by the Fund is also regional diversification and location in busy areas of major Czech cities.

Residences

We view the luxury residential segment in the Czech Republic and abroad as an important complementary part of the portfolio, aimed at a growing group of very affluent people in Europe who have a large amount of available funds and are not nearly as sensitive to market fluctuations as the average consumer. This type of property in attractive tourist locations does not lose value even in poor economic times and has a long-term stabilising role in our portfolio.

Other

These assets have a complementary function in the portfolio, for example, for development, rental or bargain sale. They generate income for the Fund through growth in their value over time, the margin on sale, or appreciation through renovation or development.

Hesitating?

Specialists can help you

You don't have to be alone when it comes to investing. If you want a specialist to advise you on your choice and set everything up for you from A to Z, contact your financial advisor or find one from among our investment intermediares. Your advisor will work with you to create a financial plan that takes full account of your situation, goals and risk tolerance.

INVESTMENT FUNDS

What are investment funds?

Investment funds represent a common investment strategy. When you put your money into a given investment fund, a professional fund manager ensures its allocation according to the fund's set strategy - for example, real estate, stocks, bonds or other securities. Thus, you needn’t agonise over what to invest in, but share in a portfolio assembled and managed by experts who take care that your money appreciates as it should.

Fund information

Fund type | AIF fund, retail investment fund, open-end mutual fund |

|---|---|

Recommended holding period | 5 years |

Required minimum holding period | 3 years |

Trading Frequency | monthly |

Minimum investment (regular and one-off) | 100 CZK |

Currency of the fund | CZK |

Class currency | CZK |

Class ISIN | CZ0008474830 |

Entry fee | max. 4 % |

Exit fee | 0 % |

Management fee (based on the value of the fund capital p.a.) | 1,70% |

Administration fee (based on the value of the fund capital p.a.) | 0,20% |

Fund launch date | 16.9.2015 |

Class launch date | 16.9.2015 |

Fund manager and administrator | INVESTIKA, investiční společnost, a.s. |

Depository of the Fund | Česká spořitelna a.s. |

Fund auditor | CLA Audit s.r.o. |

All fund classes | CZK, EUR, CZK Investment |

Fund type | AIF fund, retail investment fund, open-end mutual fund |

|---|---|

Recommended holding period | 5 years |

Required minimum holding period | 3 years |

Trading Frequency | monthly |

Minimum investment (regular and one-off) | 4 EUR |

Currency of the fund | CZK |

Class currency | EUR |

Class ISIN | CZ0008475902 |

Entry fee | max. 4 % |

Exit fee | 0 % |

Management fee (based on the value of the fund capital p.a.) | 1,70% |

Administration fee (based on the value of the fund capital p.a.) | 0,20% |

Fund launch date | 16.9.2015 |

Class launch date | 1.1.2020 (podílové listy poprvé vydány k 30.4.2020) |

Fund manager and administrator | INVESTIKA, investiční společnost, a.s. |

Depository of the Fund | Česká spořitelna a.s. |

Fund auditor | CLA Audit s.r.o. |

All fund classes | CZK, EUR, CZK Investment |

Fund type | AIF fund, retail investment fund, open-end mutual fund | |

|---|---|---|

Recommended holding period | 5 years | |

Required minimum holding period | 3 years | |

Trading Frequency | monthly | |

Minimum investment (regular and one-off) | 10 000 000 CZK, where applicable, according to the terms and conditions set out in the Investment Fund Statute | |

Currency of the fund | CZK | |

Class currency | CZK | |

Class ISIN | CZ0008476314 | |

Entry fee | does not apply | |

Exit fee | does not apply | |

Management fee (based on the value of the fund capital p.a.) | 0,85% | |

Administration fee (based on the value of the fund capital p.a.) | 0,20% | |

Fund launch date | 16.9.2015 | |

Class launch date | 25.1.2024 | |

Fund manager and administrator | INVESTIKA, investiční společnost, a.s. | |

Depository of the Fund | Česká spořitelna a.s. | |

Fund auditor | CLA Audit s.r.o. | |

All fund classes | CZK, EUR, CZK Investment |

|

Fund class performance for CZK |

||

|---|---|---|

| data as of 31. 1. 2026 | Total cumulative performance of the fund (class CZK) | Average monthly performance of the fund (class CZK) |

1M |

0,30% |

-- |

3M |

0,99% |

0,33% |

6M |

2,74% |

0,46% |

12M |

5,42% |

0,45% |

for the last 3 years |

17,48% |

0,49% |

for the last 5 years |

33,23% |

0,55% |

for the calendar year |

0,30% |

0,30% |

since the establishment of the fund |

70,00% |

0,57% |

| Price per Certificate Unit třídy CZK | |

|---|---|

| Data as of | 31. 1. 2026 (class CZK) |

Value of a unit certificate |

1,7000 CZK |

Fund capital |

25 811 419 604,37 CZK |

Current number of unit certificates issued |

15 183 147 421pcs |

Current number of unit certificates issued |

20 066 654 713pcs |

Total number of unit certificates redeemed |

4 883 507 292pcs |

| Data as of | 01.02.2026 - 28.02.2026 (class CZK) |

|---|---|

Number of unit certificates issued for the period |

238 735 626pcs |

Number of unit certificates redeemed for the period |

131 236 480pcs |

Amount for which the unit certificates were issued |

405 850 564,20 CZK |

Amount for which the unit certificates were redeemed |

223 102 016,00 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31. 1. 2026 (whole fund) |

Fund capital |

27 118 328 010,21 CZK |

Total assets |

28 297 495 872,94 CZK |

Of which: |

|

Real estate and real estate companies |

55,32% |

Loans to real estate companies (including interest on loans) |

22,11% |

Deposits in banks |

8,58% |

Investment instruments |

3,03% |

Other |

10,96% |

|

Fund class performance for CZK |

||

|---|---|---|

| data as of 31. 12. 2025 | Total cumulative performance of the fund (class CZK) | Average monthly performance of the fund (class CZK) |

1M |

0,44% |

-- |

3M |

0,93% |

0,31% |

6M |

2,69% |

0,45% |

12M |

5,56% |

0,46% |

for the last 3 years |

17,59% |

0,49% |

for the last 5 years |

32,78% |

0,55% |

for the calendar year |

5,56% |

0,46% |

since the establishment of the fund |

69,49% |

0,57% |

| Price per Certificate Unit třídy CZK | |

|---|---|

| Data as of | 31. 12. 2025 (class CZK) |

Value of a unit certificate |

1,6949 CZK |

Fund capital |

25 419 035 268,36 CZK |

Current number of unit certificates issued |

14 996 981 997pcs |

Current number of unit certificates issued |

19 792 542 780pcs |

Total number of unit certificates redeemed |

4 795 560 783pcs |

| Data as of | 01.01.2026 - 31.01.2026 (class CZK) |

|---|---|

Number of unit certificates issued for the period |

274 111 933pcs |

Number of unit certificates redeemed for the period |

87 946 509pcs |

Amount for which the unit certificates were issued |

464 592 335,33 CZK |

Amount for which the unit certificates were redeemed |

149 060 537,11 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31. 12. 2025 (whole fund) |

Fund capital |

26 673 242 806,99 CZK |

Total assets |

27 988 375 978,89 CZK |

Of which: |

|

Real estate and real estate companies |

55,42% |

Loans to real estate companies (including interest on loans) |

22,22% |

Deposits in banks |

8,27% |

Investment instruments |

3,04% |

Other |

11,05% |

|

Fund class performance for CZK |

||

|---|---|---|

| data as of 30. 11. 2025 | Total cumulative performance of the fund (class CZK) | Average monthly performance of the fund (class CZK) |

1M |

0,24% |

-- |

3M |

1,50% |

0,50% |

6M |

2,58% |

0,43% |

12M |

5,26% |

0,44% |

for the last 3 years |

17,30% |

0,48% |

for the last 5 years |

33,63% |

0,56% |

for the calendar year |

5,10% |

0,46% |

since the establishment of the fund |

68,75% |

0,57% |

| Price per Certificate Unit třídy CZK | |

|---|---|

| Data as of | 30. 11. 2025 (class CZK) |

Value of a unit certificate |

1,6875 CZK |

Fund capital |

25 014 596 307,68 CZK |

Current number of unit certificates issued |

14 823 131 908pcs |

Current number of unit certificates issued |

19 530 710 148pcs |

Total number of unit certificates redeemed |

4 707 578 240pcs |

| Data as of | 01.12.2025 - 31.12.2025 (class CZK) |

|---|---|

Number of unit certificates issued for the period |

261 832 632pcs |

Number of unit certificates redeemed for the period |

87 982 543pcs |

Amount for which the unit certificates were issued |

441 842 633,61 CZK |

Amount for which the unit certificates were redeemed |

148 470 543,06 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 30. 11. 2025 (whole fund) |

Fund capital |

26 191 208 636,31 CZK |

Total assets |

27 507 489 967,69 CZK |

Of which: |

|

Real estate and real estate companies |

54,81% |

Loans to real estate companies (including interest on loans) |

25,87% |

Deposits in banks |

3,50% |

Investment instruments |

3,08% |

Other |

12,74% |

|

Fund class performance for CZK |

||

|---|---|---|

| data as of 31. 10. 2025 | Total cumulative performance of the fund (class CZK) | Average monthly performance of the fund (class CZK) |

1M |

0,25% |

-- |

3M |

1,73% |

0,58% |

6M |

2,67% |

0,45% |

12M |

5,17% |

0,43% |

for the last 3 years |

17,43% |

0,48% |

for the last 5 years |

33,05% |

0,55% |

for the calendar year |

4,85% |

0,48% |

since the establishment of the fund |

68,34% |

0,57% |

| Price per Certificate Unit třídy CZK | |

|---|---|

| Data as of | 31. 10. 2025 (class CZK) |

Value of a unit certificate |

1,6834 CZK |

Fund capital |

24 754 740 144,24 CZK |

Current number of unit certificates issued |

14 705 123 258pcs |

Current number of unit certificates issued |

19 294 672 460pcs |

Total number of unit certificates redeemed |

4 589 549 202pcs |

| Data as of | 01.11.2025 - 30.11.2025 (class CZK) |

|---|---|

Number of unit certificates issued for the period |

236 037 688pcs |

Number of unit certificates redeemed for the period |

118 029 038pcs |

Amount for which the unit certificates were issued |

397 345 881,59 CZK |

Amount for which the unit certificates were redeemed |

198 690 082,16 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31. 10. 2025 (whole fund) |

Fund capital |

25 851 618 759,30 CZK |

Total assets |

27 027 258 780,36 CZK |

Of which: |

|

Real estate and real estate companies |

54,26% |

Loans to real estate companies (including interest on loans) |

24,00% |

Deposits in banks |

5,44% |

Investment instruments |

3,12% |

Other |

13,18% |

|

Fund class performance for CZK |

||

|---|---|---|

| data as of 30. 9. 2025 | Total cumulative performance of the fund (class CZK) | Average monthly performance of the fund (class CZK) |

1M |

1,00% |

-- |

3M |

1,74% |

0,58% |

6M |

3,29% |

0,55% |

12M |

5,06% |

0,42% |

for the last 3 years |

17,78% |

0,49% |

for the last 5 years |

33,41% |

0,56% |

for the calendar year |

4,58% |

0,51% |

since the establishment of the fund |

67,92% |

0,57% |

| Price per Certificate Unit třídy CZK | |

|---|---|

| Data as of | 30. 9. 2025 (class CZK) |

Value of a unit certificate |

1,6792 CZK |

Fund capital |

24 495 155 883,93 CZK |

Current number of unit certificates issued |

14 586 981 176pcs |

Current number of unit certificates issued |

19 064 078 021pcs |

Total number of unit certificates redeemed |

4 477 096 845pcs |

| Data as of | 01.10.2025 - 31.10.2025 (class CZK) |

|---|---|

Number of unit certificates issued for the period |

230 594 439pcs |

Number of unit certificates redeemed for the period |

112 452 357pcs |

Amount for which the unit certificates were issued |

387 214 141,73 CZK |

Amount for which the unit certificates were redeemed |

188 829 998,06 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 30. 9. 2025 (whole fund) |

Fund capital |

25 531 373 960,67 CZK |

Total assets |

26 740 913 361,81 CZK |

Of which: |

|

Real estate and real estate companies |

54,63% |

Loans to real estate companies (including interest on loans) |

23,72% |

Deposits in banks |

2,05% |

Investment instruments |

3,14% |

Other |

16,46% |

|

Fund class performance for CZK |

||

|---|---|---|

| data as of 31. 8. 2025 | Total cumulative performance of the fund (class CZK) | Average monthly performance of the fund (class CZK) |

1M |

0,48% |

-- |

3M |

1,06% |

0,35% |

6M |

2,81% |

0,47% |

12M |

4,30% |

0,36% |

for the last 3 years |

17,50% |

0,49% |

for the last 5 years |

33,35% |

0,56% |

for the calendar year |

3,55% |

0,44% |

since the establishment of the fund |

66,26% |

0,56% |

| Price per Certificate Unit třídy CZK | |

|---|---|

| Data as of | 31. 8. 2025 (class CZK) |

Value of a unit certificate |

1,6626 CZK |

Fund capital |

24 071 617 859,26 CZK |

Current number of unit certificates issued |

14 478 266 903pcs |

Current number of unit certificates issued |

18 846 763 551pcs |

Total number of unit certificates redeemed |

4 368 496 648pcs |

| Data as of | 01.09.2025 - 30.09.2025 (class CZK) |

|---|---|

Number of unit certificates issued for the period |

217 314 470pcs |

Number of unit certificates redeemed for the period |

108 600 197pcs |

Amount for which the unit certificates were issued |

361 307 058,09 CZK |

Amount for which the unit certificates were redeemed |

180 558 687,83 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31. 8. 2025 (whole fund) |

Fund capital |

25 060 661 586,24 CZK |

Total assets |

26 065 705 689,38 CZK |

Of which: |

|

Real estate and real estate companies |

54,70% |

Loans to real estate companies (including interest on loans) |

24,15% |

Deposits in banks |

2,60% |

Investment instruments |

3,20% |

Other |

15,35% |

|

Fund class performance for CZK |

||

|---|---|---|

| data as of 31. 7. 2025 | Total cumulative performance of the fund (class CZK) | Average monthly performance of the fund (class CZK) |

1M |

0,25% |

-- |

3M |

0,92% |

0,31% |

6M |

2,61% |

0,44% |

12M |

4,83% |

0,40% |

for the last 3 years |

17,75% |

0,49% |

for the last 5 years |

32,91% |

0,55% |

for the calendar year |

3,06% |

0,44% |

since the establishment of the fund |

65,47% |

0,56% |

| Price per Certificate Unit třídy CZK | |

|---|---|

| Data as of | 31. 7. 2025 (class CZK) |

Value of a unit certificate |

1,6547 CZK |

Fund capital |

23 748 275 531,52 CZK |

Current number of unit certificates issued |

14 352 283 336pcs |

Current number of unit certificates issued |

18 611 164 657pcs |

Total number of unit certificates redeemed |

4 258 881 321pcs |

| Data as of | 01.08.2025 - 31.08.2025 (class CZK) |

|---|---|

Number of unit certificates issued for the period |

235 598 894pcs |

Number of unit certificates redeemed for the period |

109 615 327pcs |

Amount for which the unit certificates were issued |

389 845 529,12 CZK |

Amount for which the unit certificates were redeemed |

181 380 481,85 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31. 7. 2025 (whole fund) |

Fund capital |

24 701 585 455,51 CZK |

Total assets |

25 748 217 851,31 CZK |

Of which: |

|

Real estate and real estate companies |

55,30% |

Loans to real estate companies (including interest on loans) |

24,28% |

Deposits in banks |

1,95% |

Investment instruments |

3,22% |

Other |

15,25% |

|

Fund class performance for CZK |

||

|---|---|---|

| data as of 30. 6. 2025 | Total cumulative performance of the fund (class CZK) | Average monthly performance of the fund (class CZK) |

1M |

0,33% |

-- |

3M |

1,53% |

0,51% |

6M |

2,80% |

0,47% |

12M |

4,95% |

0,41% |

for the last 3 years |

18,61% |

0,52% |

for the last 5 years |

32,71% |

0,55% |

for the calendar year |

2,80% |

0,47% |

since the establishment of the fund |

65,05% |

0,56% |

| Price per Certificate Unit třídy CZK | |

|---|---|

| Data as of | 30. 6. 2025 (class CZK) |

Value of a unit certificate |

1,6505 CZK |

Fund capital |

23 411 777 965,27 CZK |

Current number of unit certificates issued |

14 184 639 079pcs |

Current number of unit certificates issued |

18 359 545 254pcs |

Total number of unit certificates redeemed |

4 174 906 175pcs |

| Data as of | 01.07.2025 - 31.07.2025 (class CZK) |

|---|---|

Number of unit certificates issued for the period |

251 619 403pcs |

Number of unit certificates redeemed for the period |

83 975 146pcs |

Amount for which the unit certificates were issued |

415 297 803,23 CZK |

Amount for which the unit certificates were redeemed |

138 600 978,71 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 30. 6. 2025 (whole fund) |

Fund capital |

24 318 255 216,16 CZK |

Total assets |

25 304 048 543,60 CZK |

Of which: |

|

Real estate and real estate companies |

56,37% |

Loans to real estate companies (including interest on loans) |

24,65% |

Deposits in banks |

2,65% |

Investment instruments |

3,26% |

Other |

13,07% |

|

Fund class performance for CZK |

||

|---|---|---|

| data as of 31. 5. 2025 | Total cumulative performance of the fund (class CZK) | Average monthly performance of the fund (class CZK) |

1M |

0,34% |

-- |

3M |

1,73% |

0,58% |

6M |

2,61% |

0,44% |

12M |

5,53% |

0,46% |

for the last 3 years |

20,21% |

0,56% |

for the last 5 years |

32,52% |

0,54% |

for the calendar year |

2,46% |

0,49% |

since the establishment of the fund |

64,51% |

0,56% |

| Price per Certificate Unit třídy CZK | |

|---|---|

| Data as of | 31. 5. 2025 (class CZK) |

Value of a unit certificate |

1,6451 CZK |

Fund capital |

23 051 925 205,57 CZK |

Current number of unit certificates issued |

14 012 575 005pcs |

Current number of unit certificates issued |

18 080 794 248pcs |

Total number of unit certificates redeemed |

4 068 219 243pcs |

| Data as of | 01.06.2025 - 30.06.2025 (class CZK) |

|---|---|

Number of unit certificates issued for the period |

278 751 006pcs |

Number of unit certificates redeemed for the period |

106 686 932pcs |

Amount for which the unit certificates were issued |

458 573 420,40 CZK |

Amount for which the unit certificates were redeemed |

175 510 671,36 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31. 5. 2025 (whole fund) |

Fund capital |

23 930 114 854,51 CZK |

Total assets |

24 848 203 371,94 CZK |

Of which: |

|

Real estate and real estate companies |

55,77% |

Loans to real estate companies (including interest on loans) |

23,66% |

Deposits in banks |

2,08% |

Investment instruments |

3,30% |

Other |

15,19% |

|

Fund class performance for CZK |

||

|---|---|---|

| data as of 30. 4. 2025 | Total cumulative performance of the fund (class CZK) | Average monthly performance of the fund (class CZK) |

1M |

0,86% |

-- |

3M |

1,67% |

0,56% |

6M |

2,43% |

0,41% |

12M |

5,58% |

0,47% |

for the last 3 years |

20,00% |

0,56% |

for the last 5 years |

32,46% |

0,54% |

for the calendar year |

2,12% |

0,53% |

since the establishment of the fund |

63,96% |

0,56% |

| Price per Certificate Unit třídy CZK | |

|---|---|

| Data as of | 30. 4. 2025 (class CZK) |

Value of a unit certificate |

1,6396 CZK |

Fund capital |

22 713 774 886,42 CZK |

Current number of unit certificates issued |

13 852 858 530pcs |

Current number of unit certificates issued |

17 832 502 180pcs |

Total number of unit certificates redeemed |

3 979 643 650pcs |

| Data as of | 01.05.2025 - 31.05.2025 (class CZK) |

|---|---|

Number of unit certificates issued for the period |

248 292 068pcs |

Number of unit certificates redeemed for the period |

88 575 593pcs |

Amount for which the unit certificates were issued |

407 099 696,37 CZK |

Amount for which the unit certificates were redeemed |

145 228 541,71 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 30. 4. 2025 (whole fund) |

Fund capital |

23 564 019 390,24 CZK |

Total assets |

24 643 870 224,90 CZK |

Of which: |

|

Real estate and real estate companies |

55,79% |

Loans to real estate companies (including interest on loans) |

24,43% |

Deposits in banks |

1,43% |

Investment instruments |

3,31% |

Other |

15,04% |

|

Fund class performance for CZK |

||

|---|---|---|

| data as of 31. 3. 2025 | Total cumulative performance of the fund (class CZK) | Average monthly performance of the fund (class CZK) |

1M |

0,53% |

-- |

3M |

1,25% |

0,42% |

6M |

1,71% |

0,29% |

12M |

5,34% |

0,44% |

for the last 3 years |

19,44% |

0,54% |

for the last 5 years |

31,64% |

0,53% |

for the calendar year |

1,25% |

0,42% |

since the establishment of the fund |

62,57% |

0,55% |

| Price per Certificate Unit třídy CZK | |

|---|---|

| Data as of | 31. 3. 2025 (class CZK) |

Value of a unit certificate |

1,6257 CZK |

Fund capital |

22 230 153 457,65 CZK |

Current number of unit certificates issued |

13 673 982 442pcs |

Current number of unit certificates issued |

17 533 376 425pcs |

Total number of unit certificates redeemed |

3 859 393 983pcs |

| Data as of | 01.04.2025 - 30.04.2025 (class CZK) |

|---|---|

Number of unit certificates issued for the period |

299 125 755pcs |

Number of unit certificates redeemed for the period |

120 249 667pcs |

Amount for which the unit certificates were issued |

486 288 801,49 CZK |

Amount for which the unit certificates were redeemed |

195 489 884,21 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31. 3. 2025 (whole fund) |

Fund capital |

23 025 026 990,31 CZK |

Total assets |

24 031 127 242,72 CZK |

Of which: |

|

Real estate and real estate companies |

54,78% |

Loans to real estate companies (including interest on loans) |

25,84% |

Deposits in banks |

1,53% |

Investment instruments |

3,38% |

Other |

14,47% |

|

Fund class performance for CZK |

||

|---|---|---|

| data as of 28. 2. 2025 | Total cumulative performance of the fund (class CZK) | Average monthly performance of the fund (class CZK) |

1M |

0,29% |

-- |

3M |

0,87% |

0,29% |

6M |

1,45% |

0,24% |

12M |

5,34% |

0,45% |

for the last 3 years |

19,54% |

0,54% |

for the last 5 years |

31,49% |

0,52% |

for the calendar year |

0,72% |

0,36% |

since the establishment of the fund |

61,72% |

0,55% |

| Price per Certificate Unit třídy CZK | |

|---|---|

| Data as of | 28. 2. 2025 (class CZK) |

Value of a unit certificate |

1,6172 CZK |

Fund capital |

21 761 981 688,35 CZK |

Current number of unit certificates issued |

13 456 172 488pcs |

Current number of unit certificates issued |

17 225 525 420pcs |

Total number of unit certificates redeemed |

3 769 352 932pcs |

| Data as of | 01.03.2025 - 31.03.2025 (class CZK) |

|---|---|

Number of unit certificates issued for the period |

307 851 005pcs |

Number of unit certificates redeemed for the period |

90 041 051pcs |

Amount for which the unit certificates were issued |

497 856 627,04 CZK |

Amount for which the unit certificates were redeemed |

145 614 387,13 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 28. 2. 2025 (whole fund) |

Fund capital |

22 519 494 833,96 CZK |

Total assets |

23 494 641 383,09 CZK |

Of which: |

|

Real estate and real estate companies |

54,63% |

Loans to real estate companies (including interest on loans) |

27,55% |

Deposits in banks |

1,50% |

Investment instruments |

3,44% |

Other |

12,88% |

|

Fund class performance for CZK |

||

|---|---|---|

| data as of 31. 1. 2025 | Total cumulative performance of the fund (class CZK) | Average monthly performance of the fund (class CZK) |

1M |

0,44% |

-- |

3M |

0,74% |

0,25% |

6M |

2,17% |

0,36% |

12M |

5,40% |

0,45% |

for the last 3 years |

19,34% |

0,54% |

for the last 5 years |

31,82% |

0,53% |

for the calendar year |

0,44% |

0,44% |

since the establishment of the fund |

61,26% |

0,55% |

| Price per Certificate Unit třídy CZK | |

|---|---|

| Data as of | 31. 1. 2025 (class CZK) |

Value of a unit certificate |

1,6126 CZK |

Fund capital |

21 319 991 868,34 CZK |

Current number of unit certificates issued |

13 221 224 920pcs |

Current number of unit certificates issued |

16 902 008 676pcs |

Total number of unit certificates redeemed |

3 680 783 756pcs |

| Data as of | 01.02.2025 - 28.02.2025 (class CZK) |

|---|---|

Number of unit certificates issued for the period |

323 516 744pcs |

Number of unit certificates redeemed for the period |

88 569 176pcs |

Amount for which the unit certificates were issued |

521 703 099,04 CZK |

Amount for which the unit certificates were redeemed |

142 826 653,53 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31. 1. 2025 (whole fund) |

Fund capital |

22 047 532 733,38 CZK |

Total assets |

22 760 183 629,11 CZK |

Of which: |

|

Real estate and real estate companies |

55,17% |

Loans to real estate companies (including interest on loans) |

24,55% |

Deposits in banks |

2,14% |

Investment instruments |

3,53% |

Other |

14,61% |

|

Fund class performance for EUR |

||

|---|---|---|

| data as of 31. 1. 2026 | Total cumulative performance of the fund (class EUR) | Average monthly performance of the fund (class EUR) |

1M |

0,00% |

-- |

3M |

0,62% |

0,21% |

6M |

2,54% |

0,42% |

12M |

6,26% |

0,52% |

for the last 3 years |

14,16% |

0,39% |

for the last 5 years |

33,26% |

0,55% |

for the calendar year |

0,00% |

0,00% |

since the establishment of the fund |

41,14% |

0,60% |

| Price per Certificate Unit třídy EUR | |

|---|---|

| Data as of | 31. 1. 2026 (class EUR) |

Value of a unit certificate |

0,0645 EUR |

Fund capital |

38 567 714,98 EUR |

Current number of unit certificates issued |

597 518 685pcs |

Current number of unit certificates issued |

748 773 317pcs |

Total number of unit certificates redeemed |

151 254 632pcs |

| Data as of | 01.02.2026 - 28.02.2026 (class EUR) |

|---|---|

Number of unit certificates issued for the period |

13 478 572pcs |

Number of unit certificates redeemed for the period |

3 390 775pcs |

Amount for which the unit certificates were issued |

869 369,11 EUR |

Amount for which the unit certificates were redeemed |

218 704,98 EUR |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31. 1. 2026 (whole fund) |

Fund capital |

27 118 328 010,21 CZK |

Total assets |

28 297 495 872,94 CZK |

Of which: |

|

Real estate and real estate companies |

55,32% |

Loans to real estate companies (including interest on loans) |

22,11% |

Deposits in banks |

8,58% |

Investment instruments |

3,03% |

Other |

10,96% |

|

Fund class performance for EUR |

||

|---|---|---|

| data as of 31. 12. 2025 | Total cumulative performance of the fund (class EUR) | Average monthly performance of the fund (class EUR) |

1M |

0,16% |

-- |

3M |

0,78% |

0,26% |

6M |

3,04% |

0,51% |

12M |

6,79% |

0,57% |

for the last 3 years |

15,38% |

0,43% |

for the last 5 years |

34,38% |

0,57% |

for the calendar year |

6,79% |

0,57% |

since the establishment of the fund |

41,14% |

0,60% |

| Price per Certificate Unit třídy EUR | |

|---|---|

| Data as of | 31. 12. 2025 (class EUR) |

Value of a unit certificate |

0,0645 EUR |

Fund capital |

37 818 051,13 EUR |

Current number of unit certificates issued |

586 441 485pcs |

Current number of unit certificates issued |

731 393 300pcs |

Total number of unit certificates redeemed |

144 951 815pcs |

| Data as of | 01.01.2026 - 31.01.2026 (class EUR) |

|---|---|

Number of unit certificates issued for the period |

17 380 017pcs |

Number of unit certificates redeemed for the period |

6 302 817pcs |

Amount for which the unit certificates were issued |

1 121 012,30 EUR |

Amount for which the unit certificates were redeemed |

406 531,69 EUR |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31. 12. 2025 (whole fund) |

Fund capital |

26 673 242 806,99 CZK |

Total assets |

27 988 375 978,89 CZK |

Of which: |

|

Real estate and real estate companies |

55,42% |

Loans to real estate companies (including interest on loans) |

22,22% |

Deposits in banks |

8,27% |

Investment instruments |

3,04% |

Other |

11,05% |

|

Fund class performance for EUR |

||

|---|---|---|

| data as of 30. 11. 2025 | Total cumulative performance of the fund (class EUR) | Average monthly performance of the fund (class EUR) |

1M |

0,47% |

-- |

3M |

1,74% |

0,58% |

6M |

3,54% |

0,59% |

12M |

6,98% |

0,58% |

for the last 3 years |

16,46% |

0,46% |

for the last 5 years |

35,29% |

0,59% |

for the calendar year |

6,62% |

0,60% |

since the establishment of the fund |

40,92% |

0,61% |

| Price per Certificate Unit třídy EUR | |

|---|---|

| Data as of | 30. 11. 2025 (class EUR) |

Value of a unit certificate |

0,0644 EUR |

Fund capital |

36 296 581,00 EUR |

Current number of unit certificates issued |

563 834 279pcs |

Current number of unit certificates issued |

704 951 551pcs |

Total number of unit certificates redeemed |

141 117 272pcs |

| Data as of | 01.12.2025 - 31.12.2025 (class EUR) |

|---|---|

Number of unit certificates issued for the period |

26 441 749pcs |

Number of unit certificates redeemed for the period |

3 834 543pcs |

Amount for which the unit certificates were issued |

1 702 848,44 EUR |

Amount for which the unit certificates were redeemed |

246 944,58 EUR |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 30. 11. 2025 (whole fund) |

Fund capital |

26 191 208 636,31 CZK |

Total assets |

27 507 489 967,69 CZK |

Of which: |

|

Real estate and real estate companies |

54,81% |

Loans to real estate companies (including interest on loans) |

25,87% |

Deposits in banks |

3,50% |

Investment instruments |

3,08% |

Other |

12,74% |

|

Fund class performance for EUR |

||

|---|---|---|

| data as of 31. 10. 2025 | Total cumulative performance of the fund (class EUR) | Average monthly performance of the fund (class EUR) |

1M |

0,16% |

-- |

3M |

1,91% |

0,64% |

6M |

3,39% |

0,56% |

12M |

6,83% |

0,57% |

for the last 3 years |

16,97% |

0,47% |

for the last 5 years |

39,65% |

0,66% |

for the calendar year |

6,13% |

0,61% |

since the establishment of the fund |

40,26% |

0,61% |

| Price per Certificate Unit třídy EUR | |

|---|---|

| Data as of | 31. 10. 2025 (class EUR) |

Value of a unit certificate |

0,0641 EUR |

Fund capital |

34 384 716,36 EUR |

Current number of unit certificates issued |

536 453 396pcs |

Current number of unit certificates issued |

673 347 609pcs |

Total number of unit certificates redeemed |

136 894 213pcs |

| Data as of | 01.11.2025 - 30.11.2025 (class EUR) |

|---|---|

Number of unit certificates issued for the period |

31 603 942pcs |

Number of unit certificates redeemed for the period |

4 223 059pcs |

Amount for which the unit certificates were issued |

2 025 813,65 EUR |

Amount for which the unit certificates were redeemed |

270 698,06 EUR |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31. 10. 2025 (whole fund) |

Fund capital |

25 851 618 759,30 CZK |

Total assets |

27 027 258 780,36 CZK |

Of which: |

|

Real estate and real estate companies |

54,26% |

Loans to real estate companies (including interest on loans) |

24,00% |

Deposits in banks |

5,44% |

Investment instruments |

3,12% |

Other |

13,18% |

|

Fund class performance for EUR |

||

|---|---|---|

| data as of 30. 9. 2025 | Total cumulative performance of the fund (class EUR) | Average monthly performance of the fund (class EUR) |

1M |

1,11% |

-- |

3M |

2,24% |

0,75% |

6M |

4,23% |

0,71% |

12M |

6,49% |

0,54% |

for the last 3 years |

17,65% |

0,49% |

for the last 5 years |

40,04% |

0,67% |

for the calendar year |

5,96% |

0,66% |

since the establishment of the fund |

40,04% |

0,62% |

| Price per Certificate Unit třídy EUR | |

|---|---|

| Data as of | 30. 9. 2025 (class EUR) |

Value of a unit certificate |

0,0640 EUR |

Fund capital |

33 970 994,81 EUR |

Current number of unit certificates issued |

530 886 010pcs |

Current number of unit certificates issued |

663 308 824pcs |

Total number of unit certificates redeemed |

132 422 814pcs |

| Data as of | 01.10.2025 - 31.10.2025 (class EUR) |

|---|---|

Number of unit certificates issued for the period |

10 038 785pcs |

Number of unit certificates redeemed for the period |

4 471 399pcs |

Amount for which the unit certificates were issued |

642 481,84 EUR |

Amount for which the unit certificates were redeemed |

286 169,56 EUR |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 30. 9. 2025 (whole fund) |

Fund capital |

25 531 373 960,67 CZK |

Total assets |

26 740 913 361,81 CZK |

Of which: |

|

Real estate and real estate companies |

54,63% |

Loans to real estate companies (including interest on loans) |

23,72% |

Deposits in banks |

2,05% |

Investment instruments |

3,14% |

Other |

16,46% |

|

Fund class performance for EUR |

||

|---|---|---|

| data as of 31. 8. 2025 | Total cumulative performance of the fund (class EUR) | Average monthly performance of the fund (class EUR) |

1M |

0,64% |

-- |

3M |

1,77% |

0,59% |

6M |

3,77% |

0,63% |

12M |

5,32% |

0,44% |

for the last 3 years |

17,22% |

0,48% |

for the last 5 years |

35,26% |

0,59% |

for the calendar year |

4,80% |

0,60% |

since the establishment of the fund |

38,51% |

0,60% |

| Price per Certificate Unit třídy EUR | |

|---|---|

| Data as of | 31. 8. 2025 (class EUR) |

Value of a unit certificate |

0,0633 EUR |

Fund capital |

32 849 488,55 EUR |

Current number of unit certificates issued |

519 009 487pcs |

Current number of unit certificates issued |

648 225 530pcs |

Total number of unit certificates redeemed |

129 216 043pcs |

| Data as of | 01.09.2025 - 30.09.2025 (class EUR) |

|---|---|

Number of unit certificates issued for the period |

15 083 294pcs |

Number of unit certificates redeemed for the period |

3 206 771pcs |

Amount for which the unit certificates were issued |

954 771,80 EUR |

Amount for which the unit certificates were redeemed |

202 988,59 EUR |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31. 8. 2025 (whole fund) |

Fund capital |

25 060 661 586,24 CZK |

Total assets |

26 065 705 689,38 CZK |

Of which: |

|

Real estate and real estate companies |

54,70% |

Loans to real estate companies (including interest on loans) |

24,15% |

Deposits in banks |

2,60% |

Investment instruments |

3,20% |

Other |

15,35% |

|

Fund class performance for EUR |

||

|---|---|---|

| data as of 31. 7. 2025 | Total cumulative performance of the fund (class EUR) | Average monthly performance of the fund (class EUR) |

1M |

0,48% |

-- |

3M |

1,45% |

0,48% |

6M |

3,62% |

0,60% |

12M |

6,61% |

0,55% |

for the last 3 years |

17,35% |

0,48% |

for the last 5 years |

34,69% |

0,58% |

for the calendar year |

4,14% |

0,59% |

since the establishment of the fund |

37,64% |

0,60% |

| Price per Certificate Unit třídy EUR | |

|---|---|

| Data as of | 31. 7. 2025 (class EUR) |

Value of a unit certificate |

0,0629 EUR |

Fund capital |

32 238 346,38 EUR |

Current number of unit certificates issued |

512 151 734pcs |

Current number of unit certificates issued |

637 336 319pcs |

Total number of unit certificates redeemed |

125 184 585pcs |

| Data as of | 01.08.2025 - 31.08.2025 (class EUR) |

|---|---|

Number of unit certificates issued for the period |

10 889 211pcs |

Number of unit certificates redeemed for the period |

4 031 458pcs |

Amount for which the unit certificates were issued |

684 931,27 EUR |

Amount for which the unit certificates were redeemed |

253 578,71 EUR |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31. 7. 2025 (whole fund) |

Fund capital |

24 701 585 455,51 CZK |

Total assets |

25 748 217 851,31 CZK |

Of which: |

|

Real estate and real estate companies |

55,30% |

Loans to real estate companies (including interest on loans) |

24,28% |

Deposits in banks |

1,95% |

Investment instruments |

3,22% |

Other |

15,25% |

|

Fund class performance for EUR |

||

|---|---|---|

| data as of 30. 6. 2025 | Total cumulative performance of the fund (class EUR) | Average monthly performance of the fund (class EUR) |

1M |

0,64% |

-- |

3M |

1,95% |

0,65% |

6M |

3,64% |

0,61% |

12M |

5,39% |

0,45% |

for the last 3 years |

18,56% |

0,52% |

for the last 5 years |

35,79% |

0,60% |

for the calendar year |

3,64% |

0,61% |

since the establishment of the fund |

36,98% |

0,60% |

| Price per Certificate Unit třídy EUR | |

|---|---|

| Data as of | 30. 6. 2025 (class EUR) |

Value of a unit certificate |

0,0626 EUR |

Fund capital |

31 597 347,29 EUR |

Current number of unit certificates issued |

504 565 849pcs |

Current number of unit certificates issued |

624 765 399pcs |

Total number of unit certificates redeemed |

120 199 550pcs |

| Data as of | 01.07.2025 - 31.07.2025 (class EUR) |

|---|---|

Number of unit certificates issued for the period |

12 570 920pcs |

Number of unit certificates redeemed for the period |

4 985 035pcs |

Amount for which the unit certificates were issued |

786 938,86 EUR |

Amount for which the unit certificates were redeemed |

312 063,17 EUR |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 30. 6. 2025 (whole fund) |

Fund capital |

24 318 255 216,16 CZK |

Total assets |

25 304 048 543,60 CZK |

Of which: |

|

Real estate and real estate companies |

56,37% |

Loans to real estate companies (including interest on loans) |

24,65% |

Deposits in banks |

2,65% |

Investment instruments |

3,26% |

Other |

13,07% |

|

Fund class performance for EUR |

||

|---|---|---|

| data as of 31. 5. 2025 | Total cumulative performance of the fund (class EUR) | Average monthly performance of the fund (class EUR) |

1M |

0,32% |

-- |

3M |

1,97% |

0,66% |

6M |

3,32% |

0,55% |

12M |

5,07% |

0,42% |

for the last 3 years |

19,39% |

0,54% |

for the last 5 years |

35,51% |

0,59% |

for the calendar year |

2,98% |

0,60% |

since the establishment of the fund |

36,11% |

0,59% |

| Price per Certificate Unit třídy EUR | |

|---|---|

| Data as of | 31. 5. 2025 (class EUR) |

Value of a unit certificate |

0,0622 EUR |

Fund capital |

30 663 631,80 EUR |

Current number of unit certificates issued |

493 276 762pcs |

Current number of unit certificates issued |

612 299 148pcs |

Total number of unit certificates redeemed |

119 022 386pcs |

| Data as of | 01.06.2025 - 30.06.2025 (class EUR) |

|---|---|

Number of unit certificates issued for the period |

12 466 251pcs |

Number of unit certificates redeemed for the period |

1 177 164pcs |

Amount for which the unit certificates were issued |

775 401,65 EUR |

Amount for which the unit certificates were redeemed |

73 219,61 EUR |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31. 5. 2025 (whole fund) |

Fund capital |

23 930 114 854,51 CZK |

Total assets |

24 848 203 371,94 CZK |

Of which: |

|

Real estate and real estate companies |

55,77% |

Loans to real estate companies (including interest on loans) |

23,66% |

Deposits in banks |

2,08% |

Investment instruments |

3,30% |

Other |

15,19% |

|

Fund class performance for EUR |

||

|---|---|---|

| data as of 30. 4. 2025 | Total cumulative performance of the fund (class EUR) | Average monthly performance of the fund (class EUR) |

1M |

0,98% |

-- |

3M |

2,14% |

0,71% |

6M |

3,33% |

0,56% |

12M |

7,08% |

0,59% |

for the last 3 years |

18,77% |

0,52% |

for the last 5 years |

35,67% |

0,59% |

for the calendar year |

2,65% |

0,66% |

since the establishment of the fund |

35,67% |

0,59% |

| Price per Certificate Unit třídy EUR | |

|---|---|

| Data as of | 30. 4. 2025 (class EUR) |

Value of a unit certificate |

0,0620 EUR |

Fund capital |

30 089 440,37 EUR |

Current number of unit certificates issued |

485 457 672pcs |

Current number of unit certificates issued |

600 744 167pcs |

Total number of unit certificates redeemed |

115 286 495pcs |

| Data as of | 01.05.2025 - 31.05.2025 (class EUR) |

|---|---|

Number of unit certificates issued for the period |

11 554 981pcs |

Number of unit certificates redeemed for the period |

3 735 891pcs |

Amount for which the unit certificates were issued |

716 408,19 EUR |

Amount for which the unit certificates were redeemed |

231 625,24 EUR |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 30. 4. 2025 (whole fund) |

Fund capital |

23 564 019 390,24 CZK |

Total assets |

24 643 870 224,90 CZK |

Of which: |

|

Real estate and real estate companies |

55,79% |

Loans to real estate companies (including interest on loans) |

24,43% |

Deposits in banks |

1,43% |

Investment instruments |

3,31% |

Other |

15,04% |

|

Fund class performance for EUR |

||

|---|---|---|

| data as of 31. 3. 2025 | Total cumulative performance of the fund (class EUR) | Average monthly performance of the fund (class EUR) |

1M |

0,66% |

-- |

3M |

1,66% |

0,55% |

6M |

2,16% |

0,36% |

12M |

7,34% |

0,61% |

for the last 3 years |

17,18% |

0,48% |

for the last 5 years |

0,00% |

0,00% |

for the calendar year |

1,66% |

0,55% |

since the establishment of the fund |

34,35% |

0,58% |

| Price per Certificate Unit třídy EUR | |

|---|---|

| Data as of | 31. 3. 2025 (class EUR) |

Value of a unit certificate |

0,0614 EUR |

Fund capital |

29 251 581,46 EUR |

Current number of unit certificates issued |

476 279 932pcs |

Current number of unit certificates issued |

588 360 446pcs |

Total number of unit certificates redeemed |

112 080 514pcs |

| Data as of | 01.04.2025 - 30.04.2025 (class EUR) |

|---|---|

Number of unit certificates issued for the period |

12 383 721pcs |

Number of unit certificates redeemed for the period |

3 205 981pcs |

Amount for which the unit certificates were issued |

760 360,85 EUR |

Amount for which the unit certificates were redeemed |

196 847,23 EUR |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31. 3. 2025 (whole fund) |

Fund capital |

23 025 026 990,31 CZK |

Total assets |

24 031 127 242,72 CZK |

Of which: |

|

Real estate and real estate companies |

54,78% |

Loans to real estate companies (including interest on loans) |

25,84% |

Deposits in banks |

1,53% |

Investment instruments |

3,38% |

Other |

14,47% |

|

Fund class performance for EUR |

||

|---|---|---|

| data as of 28. 2. 2025 | Total cumulative performance of the fund (class EUR) | Average monthly performance of the fund (class EUR) |

1M |

0,49% |

-- |

3M |

1,33% |

0,44% |

6M |

1,50% |

0,25% |

12M |

7,39% |

0,62% |

for the last 3 years |

18,68% |

0,52% |

for the last 5 years |

0,00% |

0,00% |

for the calendar year |

0,99% |

0,50% |

since the establishment of the fund |

33,48% |

0,58% |

| Price per Certificate Unit třídy EUR | |

|---|---|

| Data as of | 28. 2. 2025 (class EUR) |

Value of a unit certificate |

0,0610 EUR |

Fund capital |

28 041 057,96 EUR |

Current number of unit certificates issued |

459 345 726pcs |

Current number of unit certificates issued |

567 599 281pcs |

Total number of unit certificates redeemed |

108 253 555pcs |

| Data as of | 01.03.2025 - 31.03.2025 (class EUR) |

|---|---|

Number of unit certificates issued for the period |

20 761 165pcs |

Number of unit certificates redeemed for the period |

3 826 959pcs |

Amount for which the unit certificates were issued |

1 266 431,74 EUR |

Amount for which the unit certificates were redeemed |

233 444,53 EUR |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 28. 2. 2025 (whole fund) |

Fund capital |

22 519 494 833,96 CZK |

Total assets |

23 494 641 383,09 CZK |

Of which: |

|

Real estate and real estate companies |

54,63% |

Loans to real estate companies (including interest on loans) |

27,55% |

Deposits in banks |

1,50% |

Investment instruments |

3,44% |

Other |

12,88% |

|

Fund class performance for EUR |

||

|---|---|---|

| data as of 31. 1. 2025 | Total cumulative performance of the fund (class EUR) | Average monthly performance of the fund (class EUR) |

1M |

0,50% |

-- |

3M |

1,17% |

0,39% |

6M |

2,88% |

0,48% |

12M |

5,57% |

0,46% |

for the last 3 years |

14,31% |

0,40% |

for the last 5 years |

0,00% |

0,00% |

for the calendar year |

0,50% |

0,50% |

since the establishment of the fund |

32,82% |

0,58% |

| Price per Certificate Unit třídy EUR | |

|---|---|

| Data as of | 31. 1. 2025 (class EUR) |

Value of a unit certificate |

0,0607 EUR |

Fund capital |

27 727 117,41 EUR |

Current number of unit certificates issued |

457 007 147pcs |

Current number of unit certificates issued |

560 023 902pcs |

Total number of unit certificates redeemed |

103 016 755pcs |

| Data as of | 01.02.2025 - 28.02.2025 (class EUR) |

|---|---|

Number of unit certificates issued for the period |

7 575 379pcs |

Number of unit certificates redeemed for the period |

5 236 800pcs |

Amount for which the unit certificates were issued |

459 825,87 EUR |

Amount for which the unit certificates were redeemed |

317 873,76 EUR |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31. 1. 2025 (whole fund) |

Fund capital |

22 047 532 733,38 CZK |

Total assets |

22 760 183 629,11 CZK |

Of which: |

|

Real estate and real estate companies |

55,17% |

Loans to real estate companies (including interest on loans) |

24,55% |

Deposits in banks |

2,14% |

Investment instruments |

3,53% |

Other |

14,61% |

|

Fund class performance for INVESTMENT |

||

|---|---|---|

| data as of 31. 1. 2026 | Total cumulative performance of the fund (class INVESTMENT) | Average monthly performance of the fund (class INVESTMENT) |

1M |

0,37% |

-- |

3M |

1,19% |

0,40% |

6M |

3,16% |

0,53% |

12M |

6,28% |

0,52% |

for the last 3 years |

0,00% |

0,00% |

for the last 5 years |

0,00% |

0,00% |

for the calendar year |

0,37% |

0,37% |

since the establishment of the fund |

12,39% |

0,54% |

| Price per Certificate Unit třídy INVESTMENT | |

|---|---|

| Data as of | 31. 1. 2026 (class INVESTMENT) |

Value of a unit certificate |

1,7254 CZK |

Fund capital |

368 555 900,44 CZK |

Current number of unit certificates issued |

213 603 431pcs |

Current number of unit certificates issued |

224 425 524pcs |

Total number of unit certificates redeemed |

10 822 093pcs |

| Data as of | 01.02.2026 - 28.02.2026 (class INVESTMENT) |

|---|---|

Number of unit certificates issued for the period |

33 190 677pcs |

Number of unit certificates redeemed for the period |

1 898 520pcs |

Amount for which the unit certificates were issued |

57 267 194,12 CZK |

Amount for which the unit certificates were redeemed |

3 275 706,41 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31. 1. 2026 (whole fund) |

Fund capital |

27 118 328 010,21 CZK |

Total assets |

28 297 495 872,94 CZK |

Of which: |

|

Real estate and real estate companies |

55,32% |

Loans to real estate companies (including interest on loans) |

22,11% |

Deposits in banks |

8,58% |

Investment instruments |

3,03% |

Other |

10,96% |

|

Fund class performance for INVESTMENT |

||

|---|---|---|

| data as of 31. 12. 2025 | Total cumulative performance of the fund (class INVESTMENT) | Average monthly performance of the fund (class INVESTMENT) |

1M |

0,51% |

-- |

3M |

1,14% |

0,38% |

6M |

3,11% |

0,52% |

12M |

6,42% |

0,53% |

for the last 3 years |

0,00% |

0,00% |

for the last 5 years |

0,00% |

0,00% |

for the calendar year |

6,42% |

0,53% |

since the establishment of the fund |

11,98% |

0,54% |

| Price per Certificate Unit třídy INVESTMENT | |

|---|---|

| Data as of | 31. 12. 2025 (class INVESTMENT) |

Value of a unit certificate |

1,7191 CZK |

Fund capital |

337 308 889,03 CZK |

Current number of unit certificates issued |

196 216 925pcs |

Current number of unit certificates issued |

206 939 314pcs |

Total number of unit certificates redeemed |

10 722 389pcs |

| Data as of | 01.01.2026 - 31.01.2026 (class INVESTMENT) |

|---|---|

Number of unit certificates issued for the period |

17 486 210pcs |

Number of unit certificates redeemed for the period |

99 704pcs |

Amount for which the unit certificates were issued |

30 060 543,61 CZK |

Amount for which the unit certificates were redeemed |

171 401,15 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31. 12. 2025 (whole fund) |

Fund capital |

26 673 242 806,99 CZK |

Total assets |

27 988 375 978,89 CZK |

Of which: |

|

Real estate and real estate companies |

55,42% |

Loans to real estate companies (including interest on loans) |

22,22% |

Deposits in banks |

8,27% |

Investment instruments |

3,04% |

Other |

11,05% |

|

Fund class performance for INVESTMENT |

||

|---|---|---|

| data as of 30. 11. 2025 | Total cumulative performance of the fund (class INVESTMENT) | Average monthly performance of the fund (class INVESTMENT) |

1M |

0,31% |

-- |

3M |

1,71% |

0,57% |

6M |

3,00% |

0,50% |

12M |

6,11% |

0,51% |

for the last 3 years |

0,00% |

0,00% |

for the last 5 years |

0,00% |

0,00% |

for the calendar year |

5,88% |

0,53% |

since the establishment of the fund |

11,41% |

0,54% |

| Price per Certificate Unit třídy INVESTMENT | |

|---|---|

| Data as of | 30. 11. 2025 (class INVESTMENT) |

Value of a unit certificate |

1,7104 CZK |

Fund capital |

299 323 965,79 CZK |

Current number of unit certificates issued |

175 002 667pcs |

Current number of unit certificates issued |

181 713 956pcs |

Total number of unit certificates redeemed |

6 711 289pcs |

| Data as of | 01.12.2025 - 31.12.2025 (class INVESTMENT) |

|---|---|

Number of unit certificates issued for the period |

25 225 358pcs |

Number of unit certificates redeemed for the period |

4 011 100pcs |

Amount for which the unit certificates were issued |

43 145 452,32 CZK |

Amount for which the unit certificates were redeemed |

6 860 585,44 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 30. 11. 2025 (whole fund) |

Fund capital |

26 191 208 636,31 CZK |

Total assets |

27 507 489 967,69 CZK |

Of which: |

|

Real estate and real estate companies |

54,81% |

Loans to real estate companies (including interest on loans) |

25,87% |

Deposits in banks |

3,50% |

Investment instruments |

3,08% |

Other |

12,74% |

|

Fund class performance for INVESTMENT |

||

|---|---|---|

| data as of 31. 10. 2025 | Total cumulative performance of the fund (class INVESTMENT) | Average monthly performance of the fund (class INVESTMENT) |

1M |

0,32% |

-- |

3M |

1,94% |

0,65% |

6M |

3,09% |

0,51% |

12M |

6,02% |

0,50% |

for the last 3 years |

0,00% |

0,00% |

for the last 5 years |

0,00% |

0,00% |

for the calendar year |

5,55% |

0,56% |

since the establishment of the fund |

11,07% |

0,55% |

| Price per Certificate Unit třídy INVESTMENT | |

|---|---|

| Data as of | 31. 10. 2025 (class INVESTMENT) |

Value of a unit certificate |

1,7051 CZK |

Fund capital |

260 126 542,29 CZK |

Current number of unit certificates issued |

152 561 795pcs |

Current number of unit certificates issued |

158 361 861pcs |

Total number of unit certificates redeemed |

5 800 066pcs |

| Data as of | 01.11.2025 - 30.11.2025 (class INVESTMENT) |

|---|---|

Number of unit certificates issued for the period |

23 352 095pcs |

Number of unit certificates redeemed for the period |

911 223pcs |

Amount for which the unit certificates were issued |

39 817 657,19 CZK |

Amount for which the unit certificates were redeemed |

1 553 726,34 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31. 10. 2025 (whole fund) |

Fund capital |

25 851 618 759,30 CZK |

Total assets |

27 027 258 780,36 CZK |

Of which: |

|

Real estate and real estate companies |

54,26% |

Loans to real estate companies (including interest on loans) |

24,00% |

Deposits in banks |

5,44% |

Investment instruments |

3,12% |

Other |

13,18% |

|

Fund class performance for INVESTMENT |

||

|---|---|---|

| data as of 30. 9. 2025 | Total cumulative performance of the fund (class INVESTMENT) | Average monthly performance of the fund (class INVESTMENT) |

1M |

1,07% |

-- |

3M |

1,95% |

0,65% |

6M |

3,71% |

0,62% |

12M |

5,91% |

0,49% |

for the last 3 years |

0,00% |

0,00% |

for the last 5 years |

0,00% |

0,00% |

for the calendar year |

5,22% |

0,58% |

since the establishment of the fund |

10,72% |

0,56% |

| Price per Certificate Unit třídy INVESTMENT | |

|---|---|

| Data as of | 30. 9. 2025 (class INVESTMENT) |

Value of a unit certificate |

1,6997 CZK |

Fund capital |

209 364 088,63 CZK |

Current number of unit certificates issued |

123 177 460pcs |

Current number of unit certificates issued |

128 685 898pcs |

Total number of unit certificates redeemed |

5 508 438pcs |

| Data as of | 01.10.2025 - 31.10.2025 (class INVESTMENT) |

|---|---|

Number of unit certificates issued for the period |

29 675 963pcs |

Number of unit certificates redeemed for the period |

291 628pcs |

Amount for which the unit certificates were issued |

50 440 234,30 CZK |

Amount for which the unit certificates were redeemed |

495 680,11 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 30. 9. 2025 (whole fund) |

Fund capital |

25 531 373 960,67 CZK |

Total assets |

26 740 913 361,81 CZK |

Of which: |

|

Real estate and real estate companies |

54,63% |

Loans to real estate companies (including interest on loans) |

23,72% |

Deposits in banks |

2,05% |

Investment instruments |

3,14% |

Other |

16,46% |

|

Fund class performance for INVESTMENT |

||

|---|---|---|

| data as of 31. 8. 2025 | Total cumulative performance of the fund (class INVESTMENT) | Average monthly performance of the fund (class INVESTMENT) |

1M |

0,54% |

-- |

3M |

1,27% |

0,42% |

6M |

3,22% |

0,54% |

12M |

5,14% |

0,43% |

for the last 3 years |

0,00% |

0,00% |

for the last 5 years |

0,00% |

0,00% |

for the calendar year |

4,10% |

0,51% |

since the establishment of the fund |

9,54% |

0,53% |

| Price per Certificate Unit třídy INVESTMENT | |

|---|---|

| Data as of | 31. 8. 2025 (class INVESTMENT) |

Value of a unit certificate |

1,6817 CZK |

Fund capital |

186 037 979,40 CZK |

Current number of unit certificates issued |

110 623 926pcs |

Current number of unit certificates issued |

115 990 719pcs |

Total number of unit certificates redeemed |

5 366 793pcs |

| Data as of | 01.09.2025 - 30.09.2025 (class INVESTMENT) |

|---|---|

Number of unit certificates issued for the period |

12 695 179pcs |

Number of unit certificates redeemed for the period |

141 645pcs |

Amount for which the unit certificates were issued |

21 349 482,53 CZK |

Amount for which the unit certificates were redeemed |

238 204,40 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31. 8. 2025 (whole fund) |

Fund capital |

25 060 661 586,24 CZK |

Total assets |

26 065 705 689,38 CZK |

Of which: |

|

Real estate and real estate companies |

54,70% |

Loans to real estate companies (including interest on loans) |

24,15% |

Deposits in banks |

2,60% |

Investment instruments |

3,20% |

Other |

15,35% |

|

Fund class performance for INVESTMENT |

||

|---|---|---|

| data as of 31. 7. 2025 | Total cumulative performance of the fund (class INVESTMENT) | Average monthly performance of the fund (class INVESTMENT) |

1M |

0,32% |

-- |

3M |

1,12% |

0,37% |

6M |

3,03% |

0,51% |

12M |

5,68% |

0,47% |

for the last 3 years |

0,00% |

0,00% |

for the last 5 years |

0,00% |

0,00% |

for the calendar year |

3,54% |

0,51% |

since the establishment of the fund |

8,95% |

0,53% |

| Price per Certificate Unit třídy INVESTMENT | |

|---|---|

| Data as of | 31. 7. 2025 (class INVESTMENT) |

Value of a unit certificate |

1,6726 CZK |

Fund capital |

161 213 778,28 CZK |

Current number of unit certificates issued |

96 387 632pcs |

Current number of unit certificates issued |

101 052 110pcs |

Total number of unit certificates redeemed |

4 664 478pcs |

| Data as of | 01.08.2025 - 31.08.2025 (class INVESTMENT) |

|---|---|

Number of unit certificates issued for the period |

14 938 609pcs |

Number of unit certificates redeemed for the period |

702 315pcs |

Amount for which the unit certificates were issued |

24 986 317,40 CZK |

Amount for which the unit certificates were redeemed |

1 174 692,07 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 31. 7. 2025 (whole fund) |

Fund capital |

24 701 585 455,51 CZK |

Total assets |

25 748 217 851,31 CZK |

Of which: |

|

Real estate and real estate companies |

55,30% |

Loans to real estate companies (including interest on loans) |

24,28% |

Deposits in banks |

1,95% |

Investment instruments |

3,22% |

Other |

15,25% |

|

Fund class performance for INVESTMENT |

||

|---|---|---|

| data as of 30. 6. 2025 | Total cumulative performance of the fund (class INVESTMENT) | Average monthly performance of the fund (class INVESTMENT) |

1M |

0,40% |

-- |

3M |

1,73% |

0,58% |

6M |

3,21% |

0,53% |

12M |

5,80% |

0,48% |

for the last 3 years |

0,00% |

0,00% |

for the last 5 years |

0,00% |

0,00% |

for the calendar year |

3,21% |

0,53% |

since the establishment of the fund |

8,60% |

0,54% |

| Price per Certificate Unit třídy INVESTMENT | |

|---|---|

| Data as of | 30. 6. 2025 (class INVESTMENT) |

Value of a unit certificate |

1,6672 CZK |

Fund capital |

124 442 929,79 CZK |

Current number of unit certificates issued |

74 640 669pcs |

Current number of unit certificates issued |

79 234 896pcs |

Total number of unit certificates redeemed |

4 594 227pcs |

| Data as of | 01.07.2025 - 31.07.2025 (class INVESTMENT) |

|---|---|

Number of unit certificates issued for the period |

21 817 214pcs |

Number of unit certificates redeemed for the period |

70 251pcs |

Amount for which the unit certificates were issued |

36 373 659,18 CZK |

Amount for which the unit certificates were redeemed |

117 122,46 CZK |

| Asset structure of the FUND | |

|---|---|

| Structure of assets as of | 30. 6. 2025 (whole fund) |

Fund capital |

24 318 255 216,16 CZK |

Total assets |

25 304 048 543,60 CZK |

Of which: |

|

Real estate and real estate companies |

56,37% |

Loans to real estate companies (including interest on loans) |

24,65% |

Deposits in banks |

2,65% |

Investment instruments |

3,26% |

Other |

13,07% |

|

Fund class performance for INVESTMENT |

||

|---|---|---|

| data as of 31. 5. 2025 | Total cumulative performance of the fund (class INVESTMENT) | Average monthly performance of the fund (class INVESTMENT) |

1M |